Free financial applications that you need to use to help you manage your finances better. Managing finances is possible for most people is not a trivial and easy matter. Managing finances requires thoroughness and careful consideration so that financial balance can be achieved and not experience shortages due to uncontrolled expenditure.

As in many areas of life, you can do it all by hand, or switch to applications to make your life easier. There are many personal finance applications out there, but many of them are paid. You can of course pay an accountant to take care of your money, but of course you have to pay a fee that you might better avoid and save it for other needs.

With the development of technology, there are currently many personal finance applications available that you can use to make your financial records more neat and well organized. For those of you who want to try, our team has summarized several financial applications that you can use to manage your financial records.

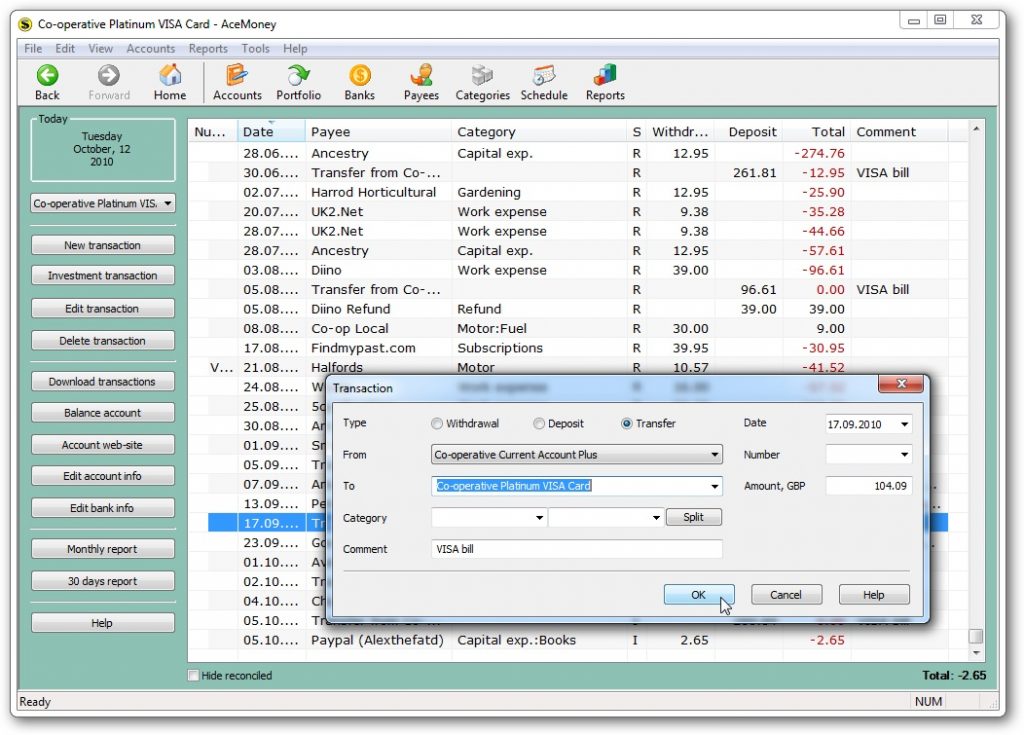

1. AceMoney Lite Software

AceMoney Lite Accounting Manager

Declared itself as an alternative to the paid application “Quicken”, setting a high standard for AceMoney, but was successfully achieved, even in free iterations. There is only support for two accounts on AceMoney Lite free and paid, but this should be enough for many people, and the paid edition of this application is only $ 40. You can even use the application to monitor your PayPal account.

Managing accounts in different currencies is not a problem, but you must enter data into a free personal finance application. That said, if you download a report from your online bank account, AceMoney Lite can then be imported to save time instead of having to manually input it. AceMoney Lite also makes it easy to monitor your expenses and investments, making it a great financial tool for anyone who wants to control their finances. Try it here.

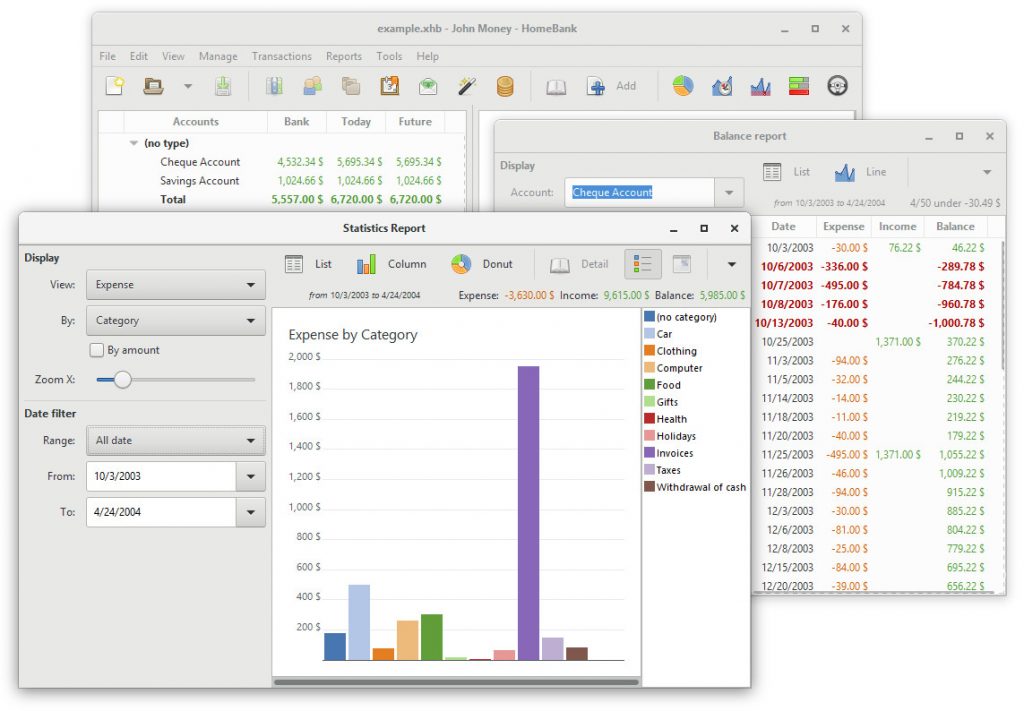

2. HomeBank Application

HomeBank Accounting Application

HomeBank is the best choice if you work on multiple platforms, or don’t even use Windows at all. HomeBank is available for Windows, macOS and Linux (there are also Android applications being developed) HomeBank can be installed normally or as a portable application, and it makes personal finance topics easily accessible. If you have used other applications such as Quicken or Microsoft Money to manage your finances, you can import data instead of having to start everything from scratch.

You can add an unlimited number of accounts to the application, and accounts are linked to each other to make it easy to transfer money, but everything is entirely dependent on manual editing. With enough data, it is possible to produce all types of reports, including predictive reports that are useful for car ownership and the like. Designed with people in mind, HomeBank is a personal finance application for people who hate personal finance applications. If you are interested in trying it, then try here.

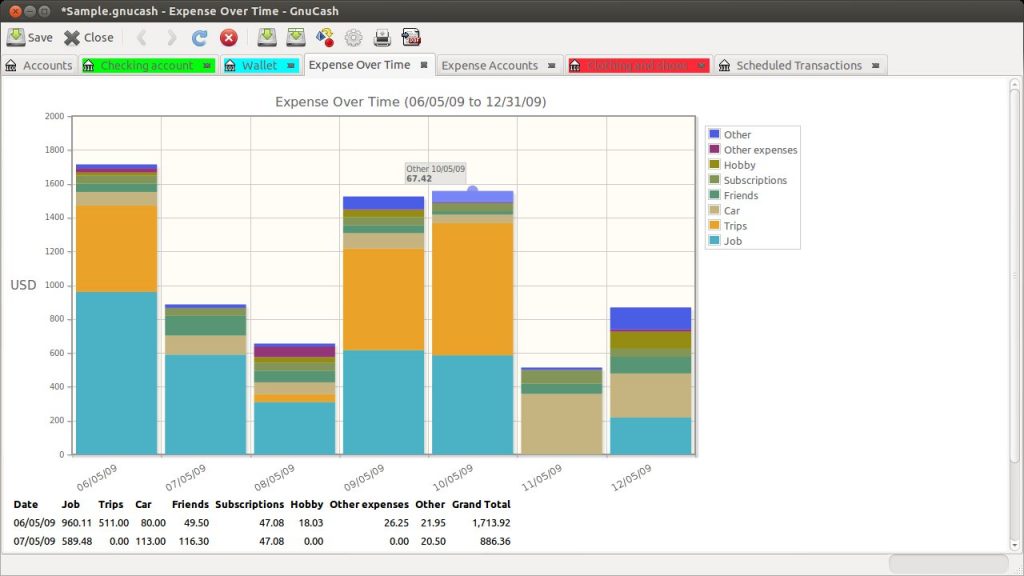

3. GnuCash Software

GnuCash Expense Chart View

GnuCash is simple enough to be used in managing household finances, but flexible enough to be used by small businesses too. Although the application is easy to use, the fact is that GnuCash is suitable for small business accounting because of the inclusion of a number of features such as payroll management and double-entry accounting.

Although it’s relatively easy to use, this free personal finance application really requires familiarity with accounting applications, and it’s easy to migrate from other applications because you can import data in QIF and dOFX formats. Support for expense tracking makes this ideal application to prepare for the tax season, and there are a large number of reporting options to help you understand your cash flow. This application is available for MacOS, Windows and Linux, and Android, and it is highly recommended that you try this great tool before you consider one of the paid alternatives. For those of you who are familiar with financial applications, this application is very suitable for you to use, for those who are not familiar, you can learn it. Please try here.

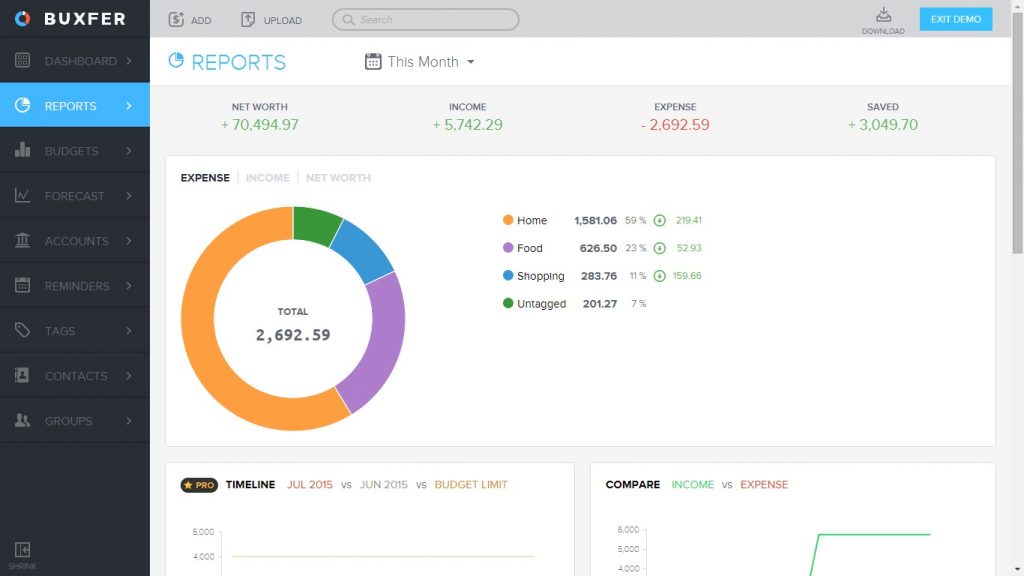

4. Buxfer Accounting Software

Buxfer Accounting Apps

Buxfer is an online application that makes it easy to manage all your accounts in one place, although there are also Android applications available. There is support for more than 15 thousand online bank accounts from around the world, and then you can withdraw all your transactions without the need to enter data manually.

Buxfer can also pull data from companies like Quicken and Mint, help you manage your budget and estimate costs and revenues, and easily monitor investments. You have to spend time categorizing transactions manually if you upload them from your report, but this is too much work to do. You can set reminders, monitor bills, and predict spending patterns. Besides that, the appearance of the Buxfer App is quite attractive and modern so it is suitable for those of you who are always up to date with technology. If this is a try then you can get it from the link here.

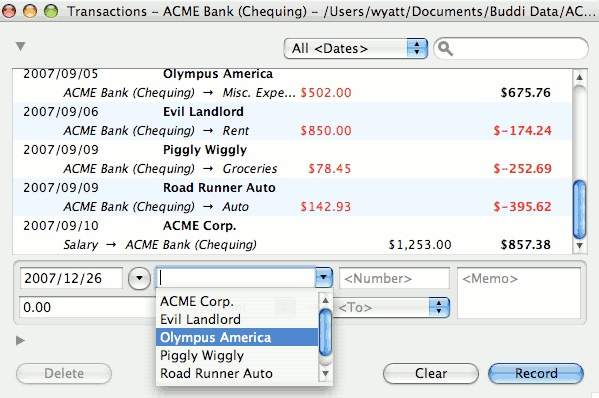

5. Buddi Application

Buddi Accounting App Interface

Proving that free personal finance applications don’t have to be complicated, Buddi keeps everything as simple as possible. Within minutes, you can manage all the accounts you need and start monitoring your expenses. Money can be easily taken and transferred between different accounts, and Buddi can produce all kinds of reports about your expenses as well as your income which are shared in various ways. If you want to save money, this application can help keep a budget and for anyone who is completely new to accounting concepts, the Buddi website has a number of helpful guides to help you get started.

The disadvantage of the Buddi application is that it requires you to install Java that you might not like, and the application itself hasn’t been updated for a while. Neither of these two factors is enough to stop us from recommending that you look at the application, maybe Buddhism is what you are looking for. If you want to try Buddi, you can find it here.

Those are some personal accounting applications that you can use to help you manage your financial flow so that it becomes more organized.